Money and Finance Coaching

“If you know you need to get your finances on track and don’t know where to begin you may greatly benefit from the guidance and direction of a financial coach.”

Publication: Noomii | Author: Michelle Tascoe

What is Money and Finance Coaching?

Money and finance coaching is focused on improving the financial status for both personal or business clients. Personal financial coaching addresses an individual or couple and the focus depends on what season they are at in life. Business clients include sole-proprietors and corporations, LLCs, S-Corps or C-Corps. A financial coach’s main objective is to address both the black and white numbers, as well as the emotional relationship with money, in order to come up with a step-by-step plan to help the client reach specific financial goals and to have the mindset and habits to support long term financial success.

Why do People Hire Money and Finance Coaches?

Currently, thousands of people need help with getting their finances on track both personally and professionally. Unfortunately, this subject is taboo for many because of the lack of personal finances being taught in schools or ever being discussed around the dinner table. Since this is such a sensitive topic, financial coaching is a highly valued service, available to help clients grow in financial literacy, confront the financially uncomfortable and create a safe place where a client can confide in a professional. This is a topic that the majority of people aren’t able to talk to friends and family about. Hence the necessary need for financial coaches is apparent in today’s society.

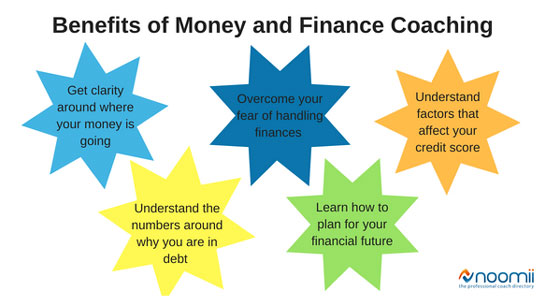

What are the Benefits of Money and Finance Coaching?

Benefits experienced by the individual

The main benefits of personal financial coaching are:

- Getting clarity around where all of your money is going

- Understanding the numbers around why you are in debt

- Uncovering the areas where your money is flying out the window

- Overcoming your fear of handling finances

- Addressing misconceptions around how to handle money

- Understanding factors that affect your credit score

- Coming to an agreement for married couples on how to handle finances together

- Getting a plan on how to buy a first home, pay off debt and be financially independent

- Learn how to plan for your financial future independent

- Have a healthy relationship with money

- To be confident, aware and responsible with personal money management

Here’s an example of personal financial coaching:

I coached a client named Chrysta and when we first started coaching, she was close to being maxed out on credit cards, owed her mom money, was living paycheck to paycheck and, although she made a decent amount of money, she had nothing to show for it at the end of every month. On our first call, she felt quite embarrassed because she actually managed the money for a production company and was excellent at her job, but strangely couldn’t translate that skillset to her own personal finances. She felt stuck and shared, “there must be something everyone else knows that I don’t know!”

Through coaching, she learned where all her money was actually going. We worked on creating a budget and a debt payoff plan. Then we uncovered her beliefs around money that were limiting her way of living. We organized her accounts and came up with financial goals that at first seemed impossible, but wonderful if they could “someday” happen. For example, being credit card debt-free, buy her first house, buying a Tesla and starting her own business where these “someday” goals.

After coaching together, within a year, she paid off all of her credit card debt, purchased a home, payed off her BMW, sold the BMW and bought a used Tesla. Chrysta is now exploring the first steps of starting her business. She was definitely surprised about the results she achieved, but as her coach I shared with her that anything is possible with the right coaching mindset and follow through

Benefits experienced by an organization

The benefits of financial coaching for a business depends on the type of organization and the circumstances that the company is facing or it’s desired growth. Many entrepreneurs, whether they are a sole proprietor or they are an owner operated corporation, who seek financial coaching may be in a place where they need financial coaching to help them with the following:

• Understand how to rightly divide between personal and business spending so that they don’t co-mingle funds

• Develop a budget for business overhead and expenses

• Understand cash flow

• How to pay off business debt

• Get clarity around the numbers and the ebb and flow of business

• Since there is no friday paycheck, financial coaching can help a business understand the average revenue necessary for a business to operate successfully year round

• Look at revenue streams and what is necessary for client retention in order to bring in the needed revenue

• Get clarity on how much to pay yourself in order to know what your business needs to make to support your living expenses

• Know how much to set aside for taxes

• Deal with back taxes

• Cut down on expenses that are not giving the business a return

• Help a client set up payroll and what is the right amount for payroll

• Understanding the flow of money through the business, subtracting expenses, payroll and paying yourself self whether an officer draw vs. w-2 payroll

• Helping a client determine at what point they can shift from a sole-proprietor to a corporation

• Help the client see how to make their business profitable

• And to answer these questions:

◦ What’s stopping me from growing as a business?

◦ Am I running my business efficiently?

◦ How can I make and keep more money from my business?

Here’s an example of business financial coaching:

One of my favorite success stories for financial coaching for a business was my client, Kate. When I first started coaching Kate, she was working part-time at UCLA. Her business was generating $2,000-3,000 in revenue and she came to me because she needed to get both her personal and business finances on track. When I learned about her business, Entry Level Hollywood, I immediately said, “Kate this is a $10,000 a month business!” I knew that Kate just needed some financial coaching around clarity between her personal and business expenses so she could really see how much her business was making, what her overhead was and the amount of money she needed to live off of in order to quit UCLA and turn her passion into a paycheck.

First, we worked on separating personal and business expenses so she could see where the money was going. We created a budget for both business and personal and crunched the numbers to see what revenue she needed to support the budget. Then we created a business model to reflect how to generate those streams of income. Inside of six months, Kate put all of this into practice and was able to replace her UCLA income. She then left UCLA to pursue her business full-time and within five months of leaving UCLA, she hit her first $10,000 month goal!

I can still remember when I got her email… “I’m happy to report that this summer I hit my first $10k month and I remember when you said that my business was a $10k+/month idea. So thank you for putting that into my head.”

I can’t even begin to express how excited I was for Kate to go beyond what she thought was possible and to see her results from financial coaching. Every business can go from a good idea to highly profitable when the numbers are focused on and adjusted in the right way. All businesses can succeed when the numbers make sense. All entrepreneurs can run their businesses more efficiently and be profitable year after year with the help of a financial coach!

How is a Money and Finance Coach Different Than a Financial Advisor?

There are many financial advisors and very few financial coaches. The difference between the two is that a financial advisor typically works for a company that has certain products that they market like stocks, mutual funds, 401Ks and IRAs. Their sole focus is to help you with a retirement plan by taking X amount of dollars that you can contribute on a monthly basis into one of their recommended products in order for you to achieve a certain desired dollar amount for your investment.

Whereas a financial coach is more focused on helping you create a budget and stick to it ,so that all the money is going into the right places. Their standpoint is to coach you through leveraging the money you are making right now to achieve all your short-term and long-term goals. These goals typically include getting out of debt, maintaining monthly living expenses, sticking to a budget, getting ahead financially and saving money for a new car, a first home purchase, a new baby, a kid’s college fund, retirement or how to go on a much-deserved vacation without getting further into debt.

A financial coach is more interested in equipping you with the tools and mindset needed for you to succeed in making great financial decisions for the rest of your life. There’s an anonymous quote that says “Don’t make it a goal to make a million dollars because of the money, but because of who you will become.”

A financial coach is most interested in the person you are becoming: one that is financially strong, confident, resourceful and independent. Thus a great financial coach will equip you with the keys to become financially free!

If you know you need to get your finances on track and don’t know where to begin you may greatly benefit from the guidance and direction of a financial coach to help you go over your goals and what could be possible.

No Comments